Business

Pros and Cons of Investing in a Term Plan

Life can be unpredictable, and in the wake of uncertainty, it is crucial to secure your future and that of your loved ones. One of the most important aspects of ensuring the security and well-being of your loved ones, even when you are no longer around is a well-considered application of term insurance.

A term plan is a type of life insurance policy that provides a financial safety net for your family in case of your untimely demise. While term plans offer numerous benefits, they also have their share of drawbacks. In this blog post, we will explore the pros and cons of investing in a term plan and discuss how you can make informed decisions using a term plan calculator.

Table of Contents

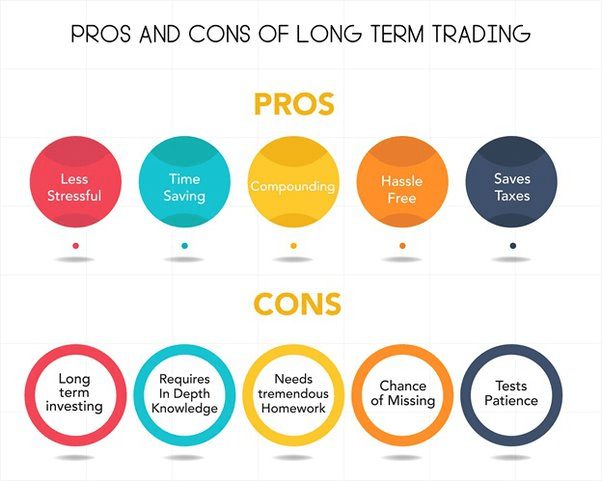

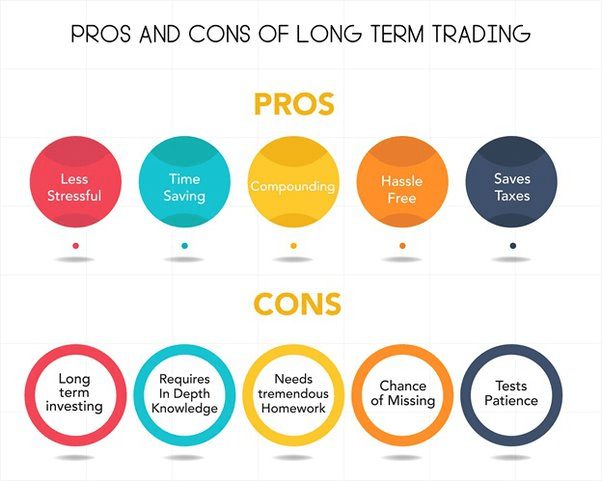

Pros of Investing in a Term Plan

Affordability: Term plans are among the most cost-effective life insurance options available. Since they provide pure life coverage without any investment or savings component, the premiums are lower compared to other types of insurance policies. This affordability allows individuals with various income levels to secure their family’s financial future.

High Coverage Amount: Term plans offer a substantial coverage amount for a relatively small premium. This means that you can ensure that your loved ones are well provided for, in case of your unexpected demise. The high coverage amount can help cover outstanding loans, educational expenses, and daily living costs.

Customizable Tenure: Term plans come with flexible policy tenures, allowing you to choose the coverage period that aligns with your financial goals and responsibilities. Whether you need coverage for 10, 20, or 30 years, term plans can be tailored to your specific needs.

Tax Benefits: Investing in a term plan offers tax benefits under Section 80C and Section 10(10D) of the Income Tax Act in India. The premiums you pay are eligible for tax deductions, making it a tax-efficient investment option.

Peace of Mind: Knowing that your family will be financially secure in your absence can provide you with peace of mind. Term plans offer a sense of security, knowing that your loved ones will have the necessary resources to maintain their quality of life.

Cons of Investing in a Term Plan

No Maturity Benefit: Term plans do not provide any maturity or survival benefits. If you outlive the policy term, you do not receive any payout or returns on the premiums paid. This can be seen as a disadvantage if you are looking for an investment that offers both protection and returns.

Lack of Savings Component: Unlike other life insurance products like endowment or ULIPs (Unit-Linked Insurance Plans), term plans do not have a savings or investment component. If you are seeking an instrument that allows you to grow your money over time, a term plan may not be the best choice. However, you may opt for ULIPs or endowment plans.

Premiums are Non-Refundable: If you stop paying the premiums or surrender the policy before the end of the term, you do not receive any refund. This means that the money you invested in premiums may be lost.

Health Conditions Affect Premiums: Your health condition and age at the time of purchasing the policy can significantly impact the premium amount. If you have pre-existing medical conditions or are older, you may end up paying higher premiums.

Limited Riders: Term plans usually offer limited additional riders or benefits compared to other insurance policies. If you require specific riders like critical illness or accidental death coverage, you may need to purchase them separately.

Using a Term Plan Calculator

A term plan calculator is a valuable tool that can help you make an informed decision when investing in a term plan. Here’s how to effectively use one:

Assess Your Financial Needs: Start by evaluating your financial needs and goals. Determine the amount of coverage required to support your family’s lifestyle, pay off debts, and meet other financial obligations.

Input Accurate Information: Provide accurate information when using the calculator, including your age, gender, desired coverage amount, and policy tenure. This ensures that the calculator provides a realistic premium estimate.

Compare Multiple Plans: Many insurance companies offer term plans with varying features and premium rates. Use the calculator to compare multiple plans to find the one that best suits your requirements and budget.

Conclusion

Investing in a term plan can be a smart financial decision, especially if you want to ensure your family’s financial security in the event of your demise. However, it’s essential to weigh the pros and cons carefully and use a term plan calculator to make an informed choice that aligns with your specific needs and goals.

While term plans lack a savings component, their affordability and high coverage make them a valuable addition to your financial portfolio, providing peace of mind and protection for your loved ones. Remember, insurance is not an expense, but an investment towards financial security.

-

Health5 years ago

Health5 years agoAdvantages and Disadvantages of Milk

-

Tech4 years ago

Tech4 years ago6 Tips to Improving E-Commerce Websites

-

Home5 years ago

Home5 years agoAdvantages and Disadvantages of Village Life in Points

-

Travel5 years ago

Travel5 years agoAdvantages and Disadvantage of Travelling

-

Sports3 years ago

Sports3 years agoThe benefits of playing an online live casino

-

Tech5 years ago

Tech5 years ago10+ Advantages and Disadvantages of Mobile Phones in Points

-

Tech5 years ago

Tech5 years agoEssay on Advantages and Disadvantages of Offline Shopping

-

Tech5 years ago

Tech5 years ago8+ Advantages and Disadvantages of Motorcycle |Having Bike